What Makes a House a Home?

There’s no denying the long-term financial benefits of owning a home, but today’s housing market may have you wondering if now’s still the time to buy. While the financial aspects of buying a home are important, the non-financial and emotional reasons are too.

Home means something different to all of us. Whether it’s sharing memories with loved ones at the kitchen table or settling in to read a book in a favorite chair, the emotional connections to our homes can be just as important as the financial ones. Here are some of the things that make a house a home.

1. You Can Be Proud of Your Accomplishment

Buying a home is a major life milestone. Whether you’re setting out to buy your first home or your fifth, congratulations will be in order when you’ve achieved your goal. The sense of accomplishment you’ll feel at the end of your journey will truly make your home feel like a special place.

2. You Have Your Own Designated Happy Place

Owning your own home offers not only safety and security, but also a comfortable place where you can relax and unwind after a long day. Sometimes that’s just what you need to feel recharged and content.

3. You Can Find the Space To Meet Your Needs

Whether you want more room for your changing lifestyle (like retirement, dedicated space for a hobby, or a personal gym) or you simply prefer to have a large backyard for entertaining, you can invest in a home that truly works for your evolving needs.

4. You Can Customize Your Surroundings

Looking to try one of those decorative wall treatments you saw online? Tired of paying an additional pet deposit for your apartment building? Or maybe you want to create an in-home yoga studio. You can do all these things in your own home.

Bottom Line

Whether you’re planning to purchase your first home or you’re ready to buy a different home to meet your needs, consider the emotional benefits that can turn a house into a happy home. When you’re ready to make a move, let’s connect.

Financial Fundamentals for First-Time Homebuyers

Financial Fundamentals for First-Time Homebuyers

Are you prepping to buy your first home? If so, one of the steps you should take early on is making sure you’re financially ready for your purchase. Here are just a few of the financial fundamentals you’ll need to focus on as you set out to buy a home.

Build Your Credit

Your credit is one element that helps determine which home loan you’ll qualify for. It also impacts your mortgage interest rate. While there are many factors that go into your mortgage application, a higher credit score could lead to a lower monthly payment in the long run.

So how do you make sure your credit is in the best shape possible when it’s time to buy? A recent article from NerdWallet lists a few tips you can use as you work to build and strengthen your credit. They include:

- Tracking your credit and disputing any errors that show up on your reports.

- Paying your bills on time. This includes making loan payments and paying down any open lines of credit.

- Keeping your credit card balances low. Paying more than your minimum monthly balance when you’re able can help.

Automate Your Savings for Your House Fund

You might also be wondering how you can achieve your down payment savings goals. Bankrate provides buyers with a number of tips to help you save, including searching for down payment assistance programs and ways you can save more, faster. As the article says:

“One of the best ways to save for anything — including a down payment — is to set it and forget it. If you receive a regular paycheck, ask your employer to direct a portion of that payment into a savings account. If you’re a freelance worker or independent contractor, set up a recurring transfer from a checking account to a savings account to establish the routine.”

Get Pre-Approved

As you prepare for your purchase, you’ll also need to have a good grasp on your budget and how much you’ll be able to borrow for your home loan. That’s where the pre-approval process comes in.

Pre-approval from a lender lets you know how much money you can borrow for your home loan. And having that knowledge, plus an understanding of your savings, can help you decide on your target price range for a house.

From there, you can start browsing for houses online and see what’s available in your area in that general price point. This can help you really understand your options so you can start to picture your future home.

For Customized Advice, Build a Team of Professionals

Finally, the best way to make you’re prepared for your purchase is to connect with trusted real estate professionals. Having expert advisors in the industry will help you make strong decisions throughout the homebuying process based on your specific goals, finances, and situation. They know the market and can guide you toward the home of your dreams.

Bottom Line

If you’re ready to get the homebuying process started, let’s connect so you can begin to build your team of professionals today.

Pursuing Your Dream of Homeownership?

What You Want To Know If You’re Pursuing Your Dream of Homeownership

If you’re a young adult, you may be thinking about your goals and priorities for the months and years ahead. And if homeownership ranks high on your goal sheet, you’re in good company. Many of your peers are also pursuing their dream of owning a home. The 2022 Millennial & Gen Z Borrower Sentiment Report from Maxwell says:

“Many young adults have demonstrated their resolve to embark on the journey toward homeownership soon. More than half of millennials and Gen Zs plan to apply for a mortgage sometime within the next year.”

Let’s take a look at why homeownership makes the top of so many young buyers’ to-do list and what you need to consider to achieve your goals if you’re one of them.

Top Motivators To Buy a Home

Before you start the homebuying process, it’s helpful to know why homeownership is so important to you. The survey mentioned above sheds light on some of the top reasons why younger generations are looking to buy a home. It finds:

- 95% believe the cost of renting is too high

- 35% think owing a home is an important wealth building tool

- 16% seek the sense of security owning a home provides

- 37% plan to use it as an investment property

No matter which of these resonates the most with you, know there are many financial and non-financial reasons why you may want to buy a home. While your top motivator may be different than that of your friends, they’re all equally valid and worthwhile.

Key Obstacles and How To Overcome Them

Whether your homeownership goals come from the heart or are driven by financial aspirations (or both), it can still be hard to know where to start when you’re looking to buy a home. From understanding the homebuying process, to getting pre-approved, and exploring down payment options, it’s a lot to wrap your head around.

The same Maxwell survey also reveals key challenges for potential buyers. Thankfully, the knowledge and guidance of a trusted real estate professional can help you overcome both. Here’s a look at two of the hurdles potential homebuyers say they face:

1. The Mortgage Process Can Be Intimidating

In the Maxwell study, 33.37% said one of their obstacles was that the mortgage process is confusing or difficult to understand.

An article by OwnUp helps explain why the mortgage process is so challenging for buyers:

“There is a general lack of knowledge about home financing. Mortgages are a complicated topic with no one-size-fits-all answer. It’s difficult to understand the space, let alone determine what the right course of action is based on your unique financial picture.”

While you may be tempted to do a quick search online to find instant answers to your questions, it may not get you the information you need to understand the full picture. Especially when it comes to financial advice, you want to lean on a true expert. Having trusted professionals on your side can help you to learn what it takes to achieve your dream of homeownership. Not to mention, an expert can give you advice specific to your situation, not generic advice like you’ll find online.

2. It’s Hard To Know How Much You Need To Save

In the Maxwell study, 45.75% believe they don’t have enough saved to cover their down payment or closing cost expenses.

What you may not realize is that, today, there’s a growing number of down payment assistance programs available nationwide to help relieve this pressure. A report from Down Payment Resource says:

“Our Q3 2022 HPI report revealed a 1.6% uptick in the number of homebuyer assistance programs available to help people finance homes, raising the number of programs to 2,309, a net increase of 36 over the previous quarter.”

Additionally, as the housing market cools, buyers are regaining some negotiation power and more sellers are willing to work with buyers to help with closing costs. Understanding what’s out there and the options available may help you achieve your dream of homeownership faster than you thought possible.

Bottom Line

If you’re serious about becoming a homeowner, know it may be more in reach than you think. Lean on trusted professionals to help you overcome challenges and prioritize your next steps.

Pre-Approval Is a Critical First Step on Your Homebuying Journey

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months ago, getting a mortgage pre-approval can be a game changer. Here’s why.

What Is Pre-Approval?

To better understand why pre-approval is key, it’s important to know what pre-approval is. The Mortgage Reports explains it like this:

“When you’re ready to take the leap into homeownership, your first step is mortgage preapproval. . . . A mortgage preapproval is when a lender determines you’re qualified for a home loan. Your preapproval letter shows the maximum loan amount you’re approved for (your home buying budget), as well as the specific interest rate and loan term you can expect.”

As part of the pre-approval process, a lender will look at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you understand your true price range and how much money you can borrow. That can make it easier when you set out to search for homes because you’ll know your overall numbers. And with mortgage rates rising and impacting affordability, a solid understanding of your numbers is even more important.

Pre-Approval Can Signal You’re a Serious Buyer

Another added benefit is that pre-approval lets the seller know you’re qualified to buy their house. A recent article from realtor.com notes:

“. . . getting pre-approved can actually improve your chances of falling into the sellers’ good graces, and you’ll want to get it done as early as you possibly can in the home-buying process.”

Even though bidding wars are easing this year as the market shifts, preapproval is still an important part of making a strong offer. It can help a seller feel more confident because it shows you’re serious about their home and that you’re a qualified buyer.

Bottom Line

Getting pre-approved for a mortgage is critical. It helps you better understand what you can borrow and shows sellers you’re serious about purchasing their home. Connect with a local real estate professional and a trusted lender so you have the tools you need to succeed as a homebuyer in today’s market.

3 Questions You May Be Asking About Selling

3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC]

![3 Questions You May Be Asking About Selling Your House Today [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/10/20151852/3-questions-you-may-be-asking-about-selling-your-house-today-MEM-1046x2637.png)

FOR SELLERS

Some Highlights

- If you’re planning to sell your house this year, you likely have questions about what the shift in the housing market means for your home sale.

- You might be wondering: Should I wait to sell? Are buyers still out there? And can I afford to buy my next home?

- Let’s connect so you can get answers to these questions and learn about the opportunities you still have in today’s housing market.

What’s Ahead for Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

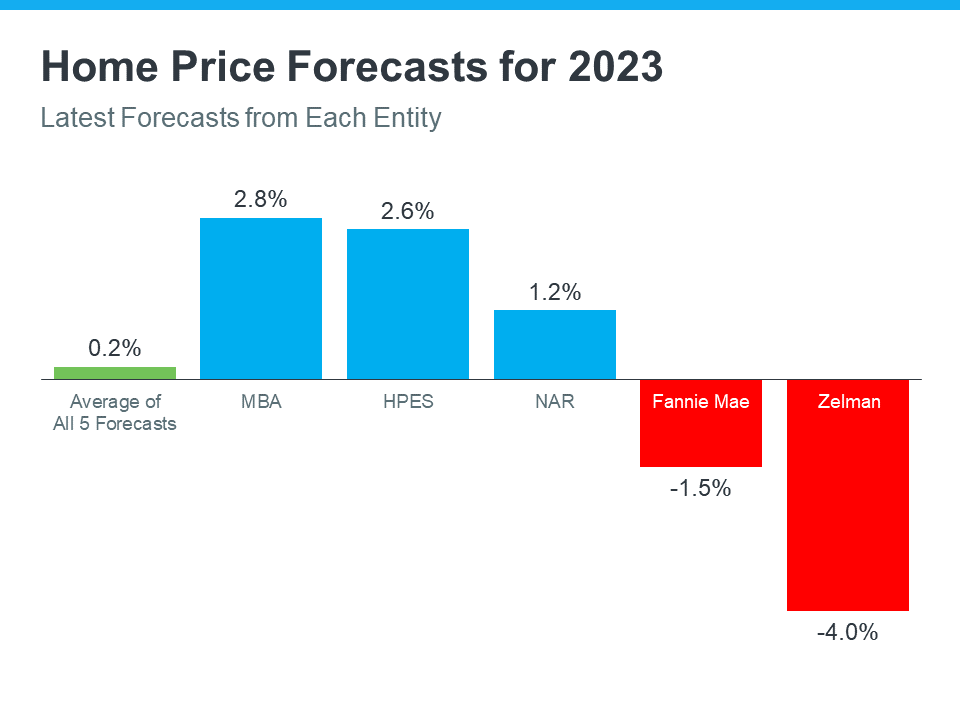

What the Experts Are Saying About Home Prices Next Year

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

How Today’s Mortgage Rates Impact Your Home Purchase

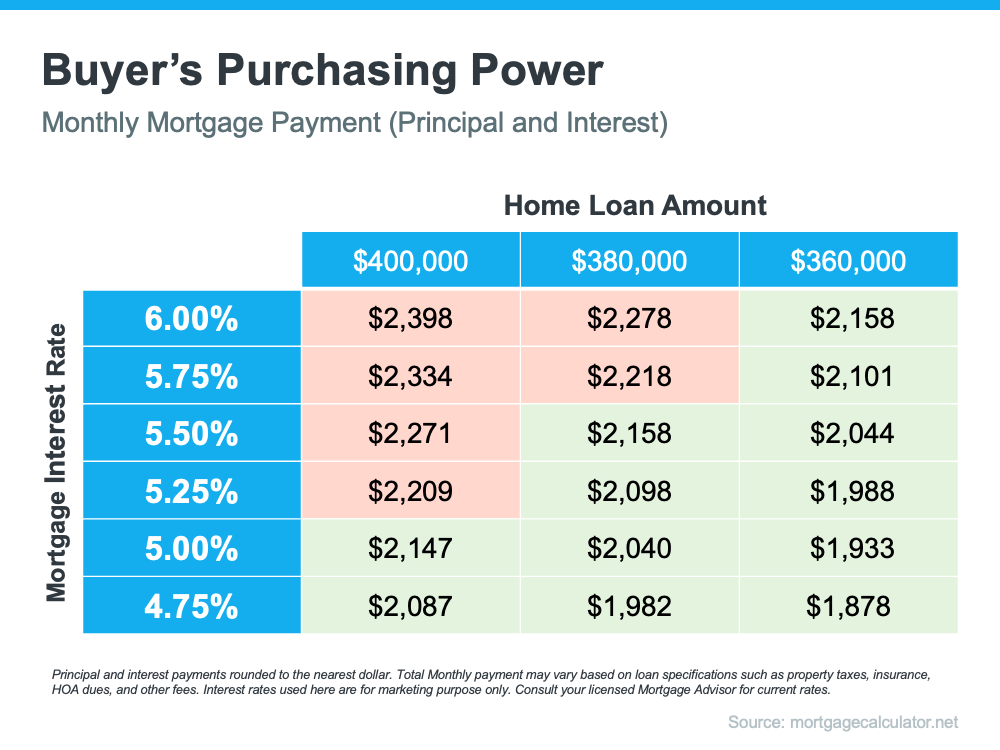

Today, the average 30-year fixed mortgage rate is above 5%, and in the near term, experts say that’ll likely go up in the months ahead. You have the opportunity to get ahead of that increase if you buy now before that impacts your purchasing power.

Mortgage Rates Play a Large Role in Your Home Search

The chart below can help you understand the general relationship between mortgage rates and a typical monthly mortgage payment within a range of loan amounts. Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within that range, while the red is a payment that exceeds it (see chart below):

As the chart shows, you’re more likely to exceed your target payment range as mortgage rates increase unless you pursue a lower home loan amount. If you’re ready to buy a home, use this as your motivation to purchase now so you can get ahead of rising rates before you have to make the decision to decrease what you borrow in order to stay comfortably within your budget.

Work with Trusted Advisors To Know Your Budget and Make a Plan

It’s critical to keep your budget top of mind as you’re searching for a home. Danielle Hale, Chief Economist at realtor.com, puts it best, advising that buyers should:

“Get preapproved with where rates are today, but also consider what would happen if rates were to go up, say another quarter of a point, . . . Know what that would do to your monthly costs and how comfortable you are with that, so that if rates do move higher, you already know how you need to adjust in response.”

No matter what, the best strategy is to work with your real estate advisor and a trusted lender to create a plan that takes rising mortgage rates into consideration. Together, you can look at your budget based on where rates are today and craft a strategy so you’re ready to adjust as rates change.

Bottom Line

Even small increases in mortgage rates can impact your purchasing power. If you’re in the process of buying a home, it’s more important than ever to have a strong plan. Let’s connect so you have a trusted real estate advisor and a lender on your side who can help you strategize to achieve your dream of homeownership this season.

The Right Expert Will Guide You Through This Unprecedented Market

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Today’s housing market is full of extremes. Mortgage rates hovering near record-lows are driving high buyer demand. On the other hand, an absence of sellers is creating record-low housing inventory. This imbalance in supply and demand is leading to a skyrocketing rate of bidding wars and more houses selling over their asking price. This is driving home price appreciation and gains in home equity. These market conditions aren’t just extreme – they can be overwhelming. Having a trusted expert to coach you through the process of buying and selling a home gives you clarity, confidence, and success through each step.

Here are just a few of the ways a real estate expert is invaluable:

- Contracts – We help with the disclosures and contracts necessary in today’s heavily regulated environment.

- Experience – We’re well-versed in real estate and experienced with the entire sales process, including how it’s changed over the past year.

- Negotiations – We act as a buffer in negotiations with all parties throughout the entire transaction while advocating for your best interests.

- Education – We simply and effectively explain today’s market conditions and decipher what they mean for your individual goals.

- Pricing – We help you understand today’s real estate values when setting the price of your home or making an offer to purchase one.

A real estate agent can be your essential guide through this unprecedented market, but truth be told, not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding the right agent should be your top priority when you’re ready to buy or sell a home.

So, how do you choose the right expert?

It starts with trust. You’ll have to be able to trust the advice your agent is going to give you, so make sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional expert can, however, give you the best possible advice based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will help you plan the steps to take for success, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions toward your goals. That’s exactly what you want and deserve.

Bottom Line

It’s crucial right now to work with a real estate expert who understands how the market is changing and what that means for home buyers and sellers. If you’re planning to make a move this year, let’s connect so you have someone who can answer your questions, give you the best advice, and guide you along the way.

Hope Is on the Horizon for Today’s Housing Shortage

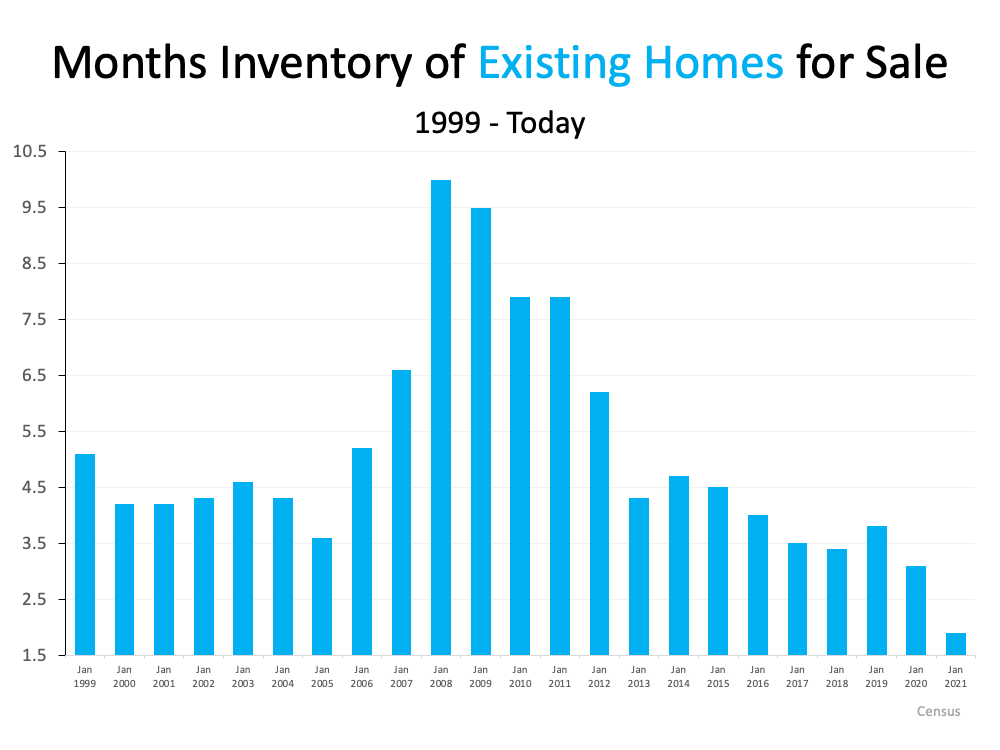

The major challenge in today’s housing market is that there are more buyers looking to purchase than there are homes available to buy. Simply put, supply can’t keep up with demand. A normal market has a 6-month supply of homes for sale. Anything over that indicates it’s a buyers’ market, but an inventory level below that threshold means we’re in a sellers’ market. Today’s inventory level sits far below the norm.

According to the Existing Home Sales Report from the National Association of Realtors (NAR):

“Total housing inventory at the end of April amounted to 1.16 million units, up 10.5% from March’s inventory and down 20.5% from one year ago (1.46 million). Unsold inventory sits at a 2.4-month supply at the current sales pace, slightly up from March’s 2.1-month supply and down from the 4.0-month supply recorded in April 2020. These numbers continue to represent near-record lows.”

Basically, while we are seeing some improvement, we’re still at near-record lows for housing inventory (as shown in the graph below). Here’s why. Since the pandemic began, sellers have been cautious when it comes to putting their homes on the market. At the same time that fewer people are listing their homes, more and more people are trying to buy them thanks to today’s low mortgage rates. The influx of buyers aiming to capitalize on those rates are purchasing this limited supply of homes as quickly as they’re coming to market. This inventory shortage doesn’t just apply to existing homes that are already built. When it comes to new construction, builders are trying to do their part to bring more newly built homes into the market. However, due to challenges with things like lumber supply, they’re also not able to keep up with demand. In their Monthly New Residential Sales report, the United States Census Bureau states:

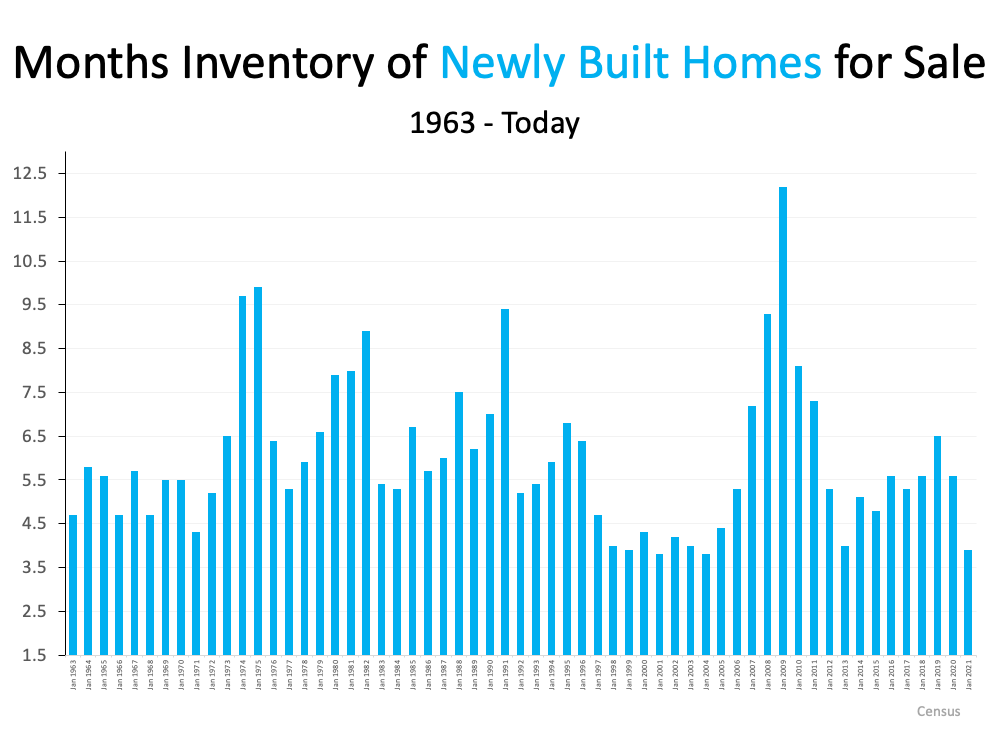

This inventory shortage doesn’t just apply to existing homes that are already built. When it comes to new construction, builders are trying to do their part to bring more newly built homes into the market. However, due to challenges with things like lumber supply, they’re also not able to keep up with demand. In their Monthly New Residential Sales report, the United States Census Bureau states:

“The seasonally‐adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.”

Sam Khater, Chief Economist at Freddie Mac, elaborates:

Sam Khater, Chief Economist at Freddie Mac, elaborates:

“In the span of five decades, entry level construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020.

While in 2020 only 65,000 entry-level homes were completed, there were 2.38 million first-time homebuyers that purchased homes. Not all renters looking to purchase their first home were in the market for entry-level homes, however, the large disparity illustrates the significant and rapidly widening gap between entry-level supply and demand.”

Despite today’s low inventory, there is hope on the horizon.

Regarding existing home sales, Sabrina Speianu, Senior Economic Research Analyst at realtor.com, explains:

“In May, newly listed homes grew by 5.4% on a year-over-year basis compared to the earlier days of the COVID-19 pandemic last year…

In May, the share of newly listed homes compared to active daily inventory hit a historical high of 44.4%, 17.3 percentage points higher than last year and 15.1 percentage points above typical levels seen in 2017 to 2019. This is a reflection of quickly selling homes and, for buyers, it means that while they can expect fresh new listings every week, they will have to be prepared to move quickly on desirable homes.”

As for newly built homes, builders are also confident about what’s ahead for housing inventory. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), shares:

“Builder confidence in the market remains strong due to a lack of resale inventory, low mortgage interest rates, and a growing demographic of prospective home buyers.”

Things are starting to look up for residential real estate inventory. As the country continues to reopen, more houses are likely to be listed for sale. However, as long as buyer demand remains high, it will take time for the balance between supply and demand to truly neutralize.

Bottom Line

Although it may be challenging to find a house to buy in today’s market, there is hope on the horizon. Let’s connect to talk about your home search so we can find your dream home this summer.

6 Reasons to Celebrate National Homeownership Month

Our homes are so much more than the houses we live in. For many, they’ve also become our workplaces, schools for our children, and safe harbors in which we’ve weathered the toughest moments of a global pandemic. Today, 65.6% of Americans call their homes their own, a rate that has risen to its highest point in 8 years.

As National Homeownership Month kicks off this June, homeowners have every reason to celebrate. A survey by Gallup just ranked real estate as the best investment you can make for the eighth year in a row. However, unlike other investment options, the benefits of owning a home aren’t purely financial. Here are the top ways Americans are winning by owning a home.

Non-Financial Benefits:

1. Civic Participation: Owning a home is owning a part of your neighborhood. Homeowners have a stronger connection to their neighborhoods and are more committed to volunteer work and other ways to get involved.

2. Pride of Ownership: Owning a home is having a space that is uniquely yours. You can customize it to your personal liking and make it reflect your personality and values.

3. A Safe Space: Owning a home gives you a sense of security and privacy – two things that have become even more valuable as we’ve tackled the challenges of the recent health crisis.

Financial Benefits:

1. Forced Savings: Owning a home builds equity. Your equity grows with each payment you make toward your mortgage. This form of forced savings can be used down the road to help you accomplish your biggest financial goals.

2. Appreciation: Owning a home is making an investment that steadily gains value, and experts project home values will continue to rise in the years to come.

3. Stability: Owning a home means having better control over your future housing payments. Over the years, a mortgage stays relatively steady, but rent costs continue to rise.

Bottom Line

If you own your home, take time this June to celebrate the ways homeownership has added value to your life. If you hope to become a homeowner this year, let’s connect today to take the first steps toward achieving your goal.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link